rsu tax rate us

Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. Unlike the much more complicated ESPP they get taxed the same way as your income.

Once shares vest they are yours to keep.

. The 22 doesnt include state income Social Security and Medicare tax withholding. Vesting after making over 200k single 250k jointly. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

Vesting after making over 137700. At the time of vesting. When the RSU vest with the employee he need to include it in his salary income as perquisite and pay tax on same.

The value of over 1 million will be taxed at 37. In some states such as California the total tax withholding on your RSU is around 40. Most companies will withhold federal income taxes at a flat rate of 22.

Even if the share price drops to 5 a share you could still make 1500. The timing of RSU tax is exactly the same as any other. For people working in California the total tax withholding on your RSUs are actually around 40.

Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns. Most employers will withhold taxes on your RSUs at a rate of 22 but you could easily be in a higher tax bracket than that. This doesnt include state income Social Security or Medicare tax withholding.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. Marginal is the rate you pay on the next dollar of earned income whereas effective tax rate is the average rate you pay on every dollar of income. In order to make employee compensation more manageable for tech companies at least a portion of it can be paid in the form.

Restricted Stock Units RSUs Tax Calculator. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. With RSUs if 300 shares vest at 10 a share selling yields 3000. The companies many a times sell certain portion of such shares after vesting to pay the tax on such vesting.

RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. Will I get a refund laterIs there a way to avoid this. At any rate RSUs are seen as supplemental income.

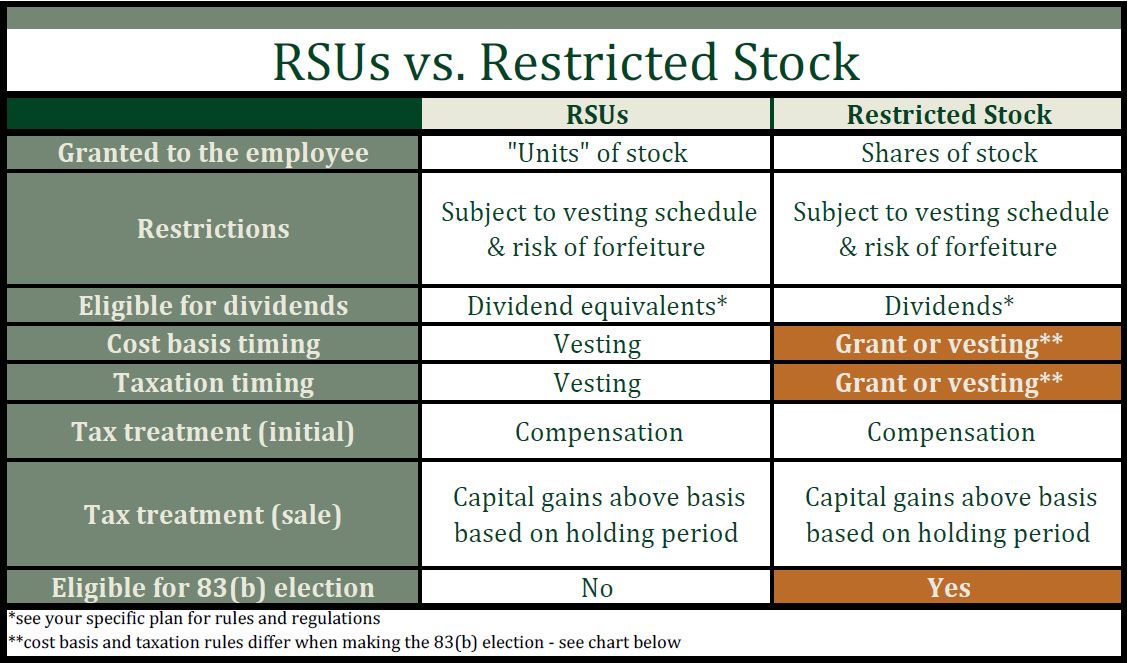

The stock is restricted because it is subject to certain conditions. The beauty of RSUs is in the simplicity of the way they get taxed. Heres the tax summary for RSUs.

Thus the RSU above attracts tax two times. Vesting after Medicare Surtax max. A single filer who earns 150k of.

This happens over time through a vesting schedule. The IRS and your state and local tax authorities if applicable view this 7500 as compensation income. Here is the information you need to know prior to jumping in.

The total is 108000 and each increment is taxable on its vesting date as compensation income when the. Ordinary tax on current share value. On this page is a Restricted Stock Unit Projection calculator or RSU calculator.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs. Long-term capital gains tax on gain if held for 1 year past vesting.

Restricted stock is a stock typically given to an executive of a company. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift.

RSU Taxes - A tech employees guide to tax on restricted stock units. Those plans generally have tax. Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250.

You receive 4000 RSUs that vest at a rate of 25 a year and the market price at grant is 18. The US uses a progressive tax system so its important to be aware of the difference between what your highest marginal income tax rate is and what your effective tax rate is. From there the RSU projection tool will model the total economic value of your grant over the years.

If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. Carol Nachbaur March 24 2022. This 7500 income from RSU vesting is called supplemental wages by the IRS.

Vesting after Social Security max. 1 At the time of vesting and 2 At the time of sale. Generally there is no tax upon the sale of shares if the shareholder together with their fiscal partner has an interest less than 5 percent in the nominal subscribed share capital determined per class of shares.

The stock price at vesting in year one is 20 1000 x 20 20000 of ordinary income at year two 25 25000 at year three 30 30000 and at year four 33 33000. For academic purposes. My rsu is distributed with higher tax rate than my actual effective tax rate.

Plan For the RSU Vesting Event Once youve used the RSU tax calculator to determine your estimated taxes and estimated proceeds youll want to make a plan so you know what you want to do with your company shares after the vesting date.

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Explaining Rsus Or Restricted Stock Units Eqvista

Rsu Taxes Explained 4 Tax Strategies For 2022

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

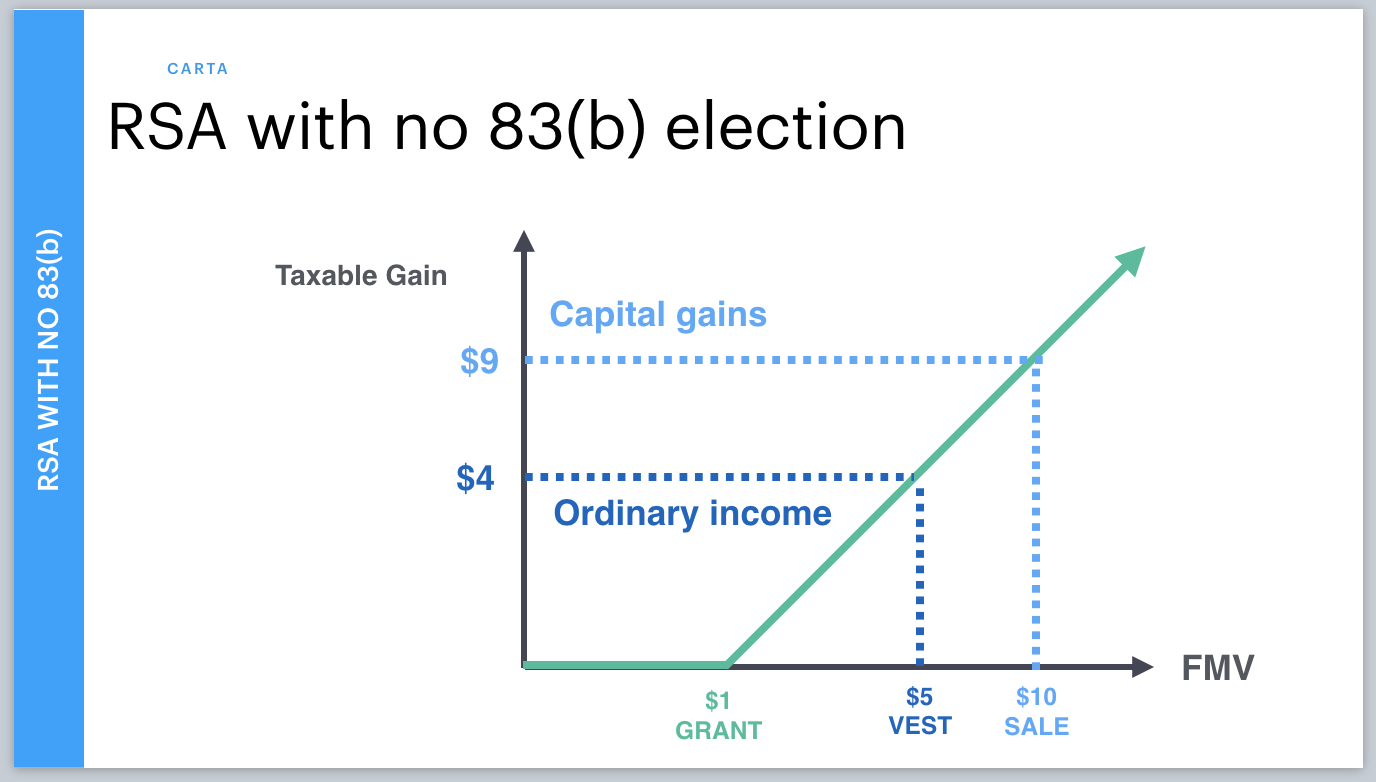

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

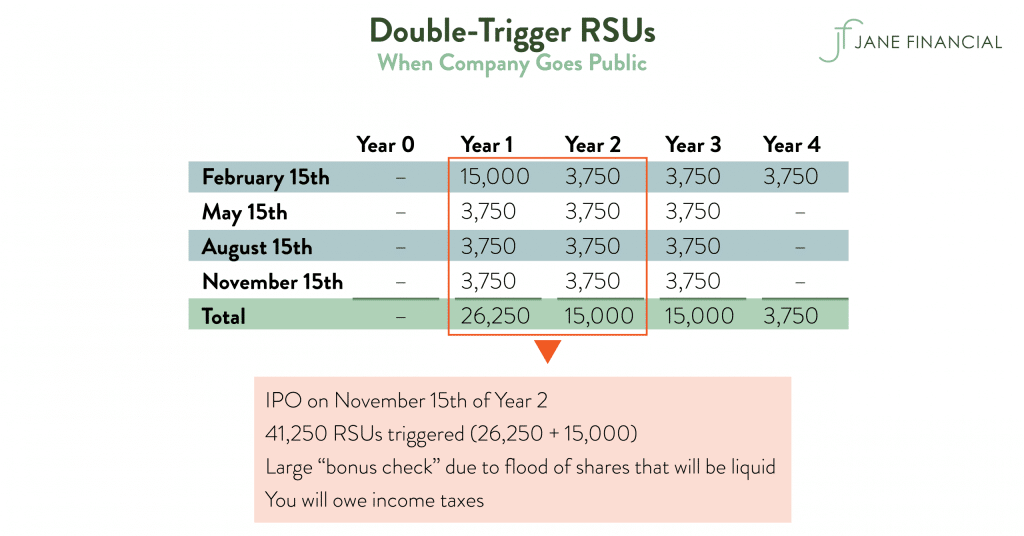

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

![]()

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners